Table of Content

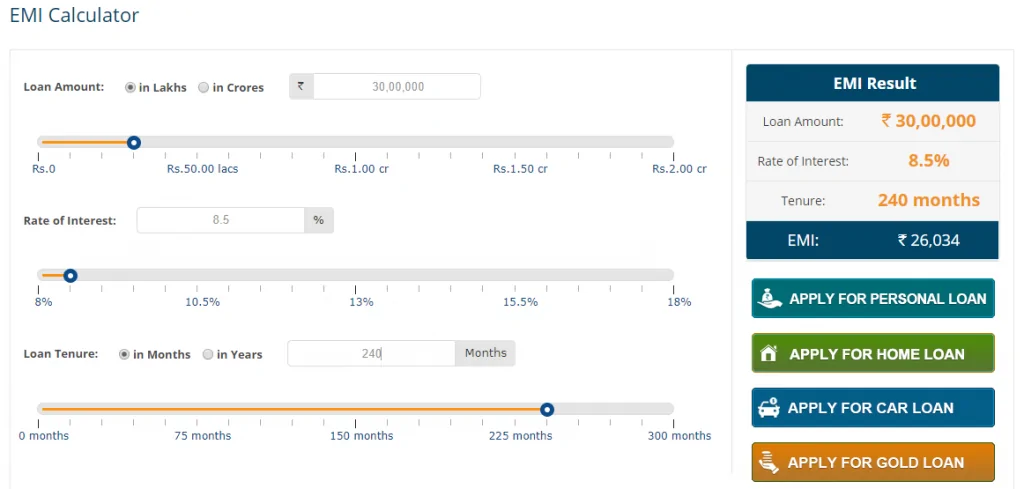

As there are multiple calculations involved in selecting the right loan for you, this online tool is ideal. Loan tenure chosen and processing fee charged by the bank. I have several problem earlier with this bank but now i am fine .

I had taken this loan a long time back and the experience i had with them was pretty good. The only thing with them is that we had to make some follow up with the bank in-order to get the loan sanctioned where we have to visit the branch. Completely yes, afinoz.com does not share data with any third party other than the concerned financial institution for application. All data is sent with a high level of encryption making it safe and secure at all times. It is one of the reputed banks in India established in 1943. The bank is serving the masses since pre-independence and brings forth a plethora of financial products.

Oriental Bank of Commerce Home Loan Interest Rate

Oriental Bank of Commerce was established many years ago in Lahore. Following partition, it closed down its branches and moved to Amritsar. Started with dedicated team of loan consultants to provide doorstep assistance to our customers, we widened our strengths with the help of technology.

This loan can also be applied to buy life insurance plans under group protection scheme for the loan applicants. The loan is not permissible for any illegal personal use. Your debt repayment schedule in regular instalments over a period of time. In this equation, the nominal rate is generally the figure being discussed when the "interest rate" is mentioned. The nominal rate is the sum of the general level of inflation and the real rate of interest that is being applied. For more information about or to do calculations involving inflation, please visit the Inflation Calculator.

How to Calculate EMI Using a Formula?

Salaried individuals or self-employed individuals can avail the housing loan by OBC. The loan is available for individuals or a group of specified individuals, also called co-borrowers. OBC home loans are available to salaried employees of state government and central government offices. If you are a self employed individual you can secure a home loan too.

Consider using the Home Loan EMI Calculator provided by BankBazaar to ascertain the EMIs that would be needed to be paid. All you need to do in order to find the payable EMI is enter details like the loan amount, tenure, interest rate, processing fee, etc. and click the ‘Calculate’ button. When it comes to meet your personal expenses, the name of Oriental Bank of Commerce stands taller in the list of personal loan seekers.

Customer Care by Banks

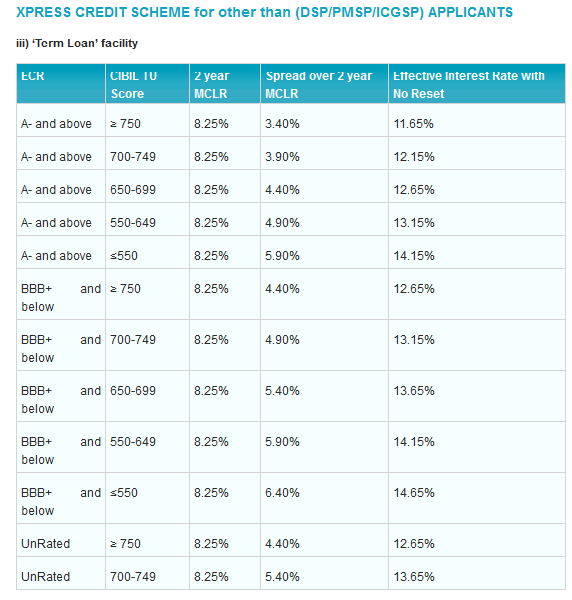

The processing fee applicable is 0.35% of the loan amount plus GST. EWS, LIG, and MIG applicants can enjoy subsidised rates under the PMAY scheme through PNB. At what rate does Oriental Bank of Commerce charge a processing fee for personal loans? OBC charges a processing fee of 0.50% of the loan amount with a minimum of Rs.500 along with Service Tax. Example – If you have taken a personal loan of Rs.2.5 lakh from OBC at an interest rate of 13.76% p.a., you will be charged a processing fee of 1%. Based on this, the loan repayment details for different tenures are as indicated above.

When the economy is slow and demand for loans is low, it is possible to find lower interest rates. When the unemployment rate is high, consumers spend less money, and economic growth slows. However, when the unemployment rate is too low, it may lead to rampant inflation, a fast wage increase, and a high cost of doing business. Conversely, when unemployment within an economy is low and there is a lot of consumer activity, interest rates will go up. The bank now determines whether to accept or refuse your application, which is by far the most crucial step in the whole home loan process. To avoid having your loan denied, you must have all of the necessary paperwork on time.

Oriental Bank of Commerce Plot Loans – For Buying a New Plot

If you want to get your house furnished, like loan to buy refrigerators or televisions. Any major furnishing purpose you have, OBC home loan will work for you. OBC’s home loans also have some of the most extensive loan tenures in the market of up to 40 years. This is highest tenure among all home loans presently in the market.

Thanks for helping me to get marriage loan for my daughter. HDFC is good bank always having quality products & services with good reward system for their customer. Consistent customer support and quality of service are the two main factors which helped us to survive the competition and beat the odds.

The interest subsidy is available at rates which range from up to 6.5% p.a. Depending on the category under which the beneficiary falls. The above eligibility criteria was shown to give you a fair idea of the basic necessities that you need to keep in place to get the nod for a personal loan from OBC. But equally necessary is the assessment from your side to visualize the loan amount that you can actually demand based on your income and savings. The assessment can be done via the bank’s personal loan eligibility calculator.

The maximum age is 70 years for salaried individuals with a pension account. To fasten the process of loans and credit cards approval. Borrow at opportune moments—While borrowers have no control over economic factors, they can choose to borrow during times when economic factors are more favorable.

Oriental Bank of Commerce accepts a prepayment at nil charges in case of floating rate home loans. When a prepayment is made, the outstanding balance of the principal amount on your home loan gets reduced. The bank verifies the papers you send after they have been submitted. Banks get up to two days to check your paperwork, which is vital to the home loan process. You will also be invited to visit the bank and participate in a face-to-face interview during this period. This is the bank’s way of ensuring that you will be able to repay the loan within the agreed-upon time frame.

List all the credentials you will need and prepare copies of it to submit with your application. One can even do it from the comfort of the homes, making the process less of a headache for the NRI who is still settling in. The interest rate that is available for an NRI or POI to get a home loan from OBC is 9.75%. Items like laptops, refrigerators, air conditioners, televisions, etc. will fall in the consumer durables category. Construction of a house on a plot of land already possessed by the applicant.

No comments:

Post a Comment